Do You Need Help? Here Us : Tel : +86 595 22486398

Do You Need Help? Here Us : Tel : +86 595 22486398

Overseas report: Regarding electric construction machinery, the market prospects in Central Europe are bright, while those in North America are bleak

May 09, 2025Off-Highway Research, a British construction machinery consulting company, released a research report on the global electric construction machinery market. The application rate of electric construction machinery in China is unexpectedly high, and Europe is also beginning to emerge, but the sales volume of electric construction machinery in North America is low, and the prospects are not optimistic.

The new report looks at sales of machines that have traditionally been powered by diesel engines but are now becoming available in battery-electric and corded-electric versions. The report breaks down the six categories into compact track loaders, crawler excavators, compact excavators, telehandlers, wheeled excavators and wheel loaders, but excludes machines that have long been electrified, such as scissor lifts.

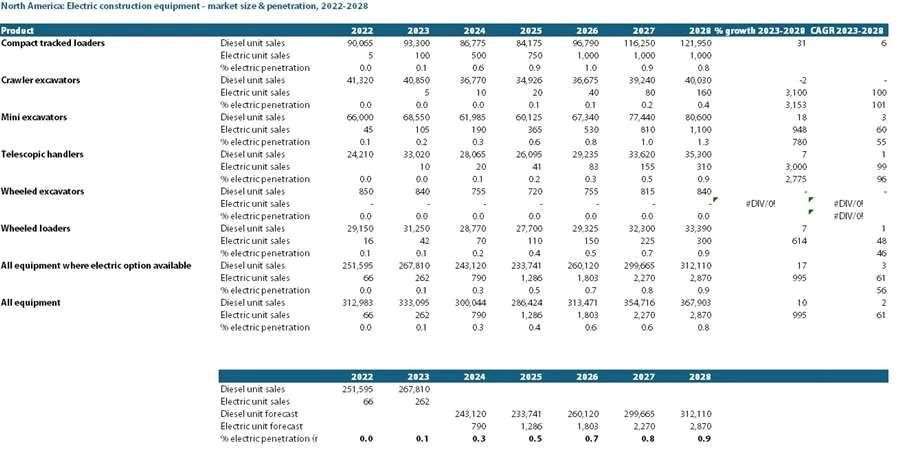

Nearly 7,300 electric construction machines were sold worldwide last year, most of which were medium-sized wheel loaders in China. This means that the global penetration rate of electric construction machinery is 0.6%. If this number sounds low, just over 250 electric sales were made in North America last year, accounting for only 0.07% of the market. These were almost all small machines, with an operating weight of 10 tons or less. The most popular were small crawler loaders and small excavators.

Pessimistic outlook

Off-Highway Research's forecast is not optimistic. Although growth rates will be good—electric devices are expected to have a compound annual growth rate (CAGR) of more than 50%—sales will still be minuscule.

To put the numbers into perspective, electric equipment sales are expected to approach 3,000 units per year by 2028, for a 1% penetration rate.Much of the pessimism in the North American market is due to the low adoption of available electric machines; the rate of introduction is expected to remain slow; and the available electric machines are skewed more toward the European market than the North American market. The exception is the compact track loader, which is sold almost exclusively in North America.

The second problem is that focusing on leasing doesn’t fully leverage the benefits of electric equipment. The economic argument is based on total cost of ownership, including lower energy costs. But compact equipment is mostly sold to rental companies, who don’t see that benefit, and fuel taxes are lower in North America than in Europe, making the economic argument even harder to make.

Tariffs make things harder

Finally, the sweeping tariffs on Chinese electric vehicles announced in May include construction equipment in the definition, meaning such imports will be subject to a 100% tariff. This could increase the current price multiple of 2.5-3 times compared to diesel machines to 5-6 times for conventional machines. This affects not only Chinese brands, but also international OEMs that produce electric equipment in China. That’s not to mention the tensions between the EPA and green advocates like California, which are also at odds with some other states and parts of the business community.

Please read on, stay posted, subscribe, and we welcome you to tell us what you think.

Add: Pudang Village, Xiamei Town, Nan'An City, Quanzhou, Fujian, China

Quanzhou Huamao Machinery Equipment Co.,Ltd All Rights Reserved.  Network SupportedSitemap | blog | Xml | Privacy Policy

Network SupportedSitemap | blog | Xml | Privacy Policy