Do You Need Help? Here Us : Tel : +86 595 22486398

Do You Need Help? Here Us : Tel : +86 595 22486398

2025 Global Construction Machinery Market Outlook: China Bucks the Trend with Electric Vehicles, North American Market Declines by 11%

November 09, 2025In 2022, this growth momentum did not weaken in any major market except China. In China, construction machinery sales began to decline sharply due to the termination of stimulus spending programs and a large number of bad debts in the real estate market. Global construction machinery sales fell by 5% in 2022, but this decline was entirely due to the Chinese market – if the Chinese market is excluded, global sales actually increased by 7% in 2022.

Construction machinery sales return to a more sustainable level.

Starting in 2023, markets outside of China began to cool down and have been gradually adjusting since, declining towards more sustainable sales levels. The most critical restraining factor is the global rise in interest rates (a necessary measure to curb runaway inflation), which has led to a slowdown in residential construction growth. Nevertheless, inflation has still had a direct impact on the market: on the one hand, project costs have increased, and on the other hand, the cost of construction machinery itself has also increased significantly.

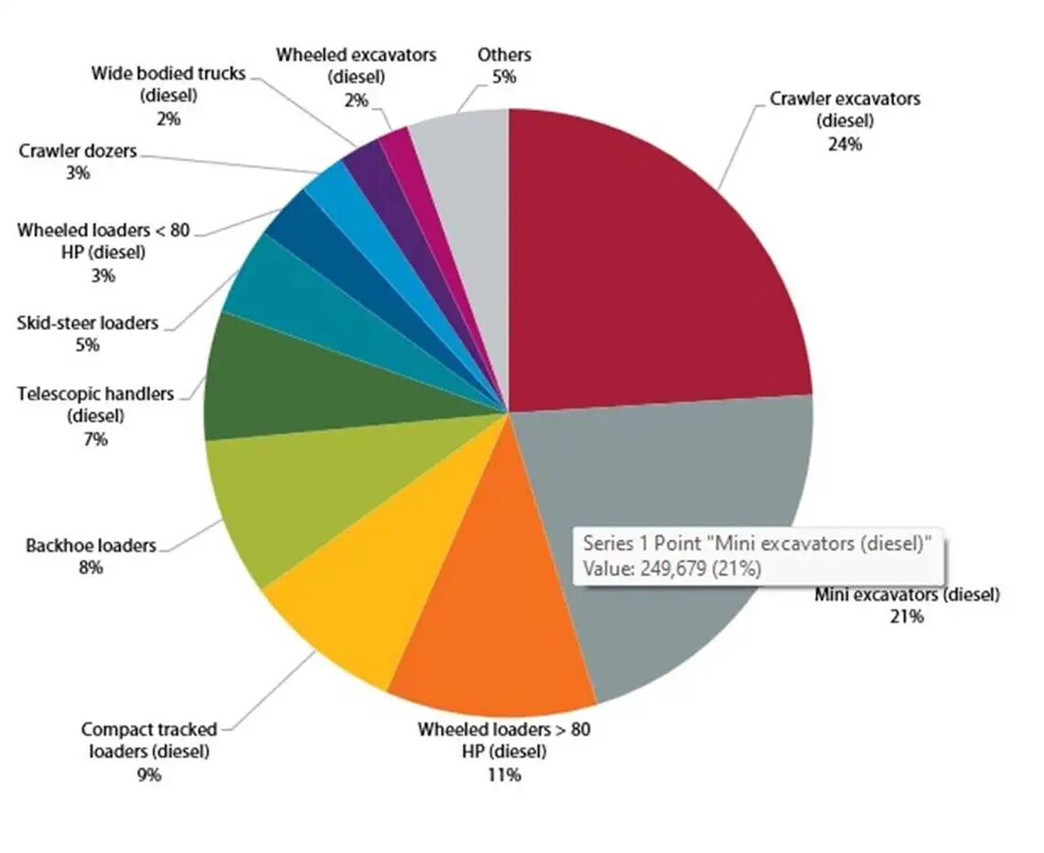

After a sharp decline in global construction machinery sales in 2023, the drop narrowed last year to only 2%. In contrast to the previous year, sales in developed markets such as Europe, Japan, and North America all declined (with Europe experiencing a particularly significant and severe drop), while sales in emerging construction machinery markets generally rebounded. This year, sales in most markets are expected to remain flat or decline, but the overall impact on global sales is projected to be only a further 2% decrease.

The Chinese market will achieve (some degree) growth.

On the positive side, China's construction machinery market is projected to grow in 2025, but this does not imply a healthy market – in fact, it is far from it. The real estate sector remains mired in difficulties, and local government debt is high. Local provinces currently lack clear pathways to improve their fiscal situation and re-fund projects, as their past strategy has consistently relied on selling land to real estate developers for funding. The projected 12% growth in China's construction machinery sales this year will primarily come from the sale of electric construction machinery, which also drove last year's growth.

China is the only market globally where electric construction machinery has truly established itself, especially in the wheel loader sector – sales of electric wheel loaders are expected to surpass those of diesel models within the next year or two. The "trade-in" program to phase out old, high-polluting diesel engines, subsidy policies for electrification, and fierce competition among China's major construction machinery original equipment manufacturers (OEMs) (which has driven down prices) have all contributed to the development of electric construction machinery.

The Chinese construction machinery market is expected to continue growing for the remainder of this decade. However, without significant changes in the core factors driving market growth, there is still a long way to go before it returns to a truly healthy state. Currently, it appears that the market will need at least five more years to return to "normal."

The European construction industry is hampered by the turbulent situation.

Over the past two or three years, high interest rates and high construction costs have led to a slump in residential construction across Europe, while the relatively active infrastructure sector is still insufficient to offset the significant adjustments this situation will bring to the construction machinery market in 2024.

At the end of the year, unprecedented political turmoil in Europe further exacerbated the region's market difficulties. Unsurprisingly, the uncertainty caused by these events led to the construction machinery markets in these three countries becoming the worst-performing markets in Europe. France's ongoing political turmoil means it will also be the worst-performing construction machinery market in Europe this year.

Last year, the Southern and Eastern European markets performed "relatively less badly," with limited declines. However, a general downward trend persisted, with only Ireland seeing growth in construction machinery sales last year. Although several major markets, including Germany and the UK, have shown improvement this year, European construction machinery sales are projected to decline further by 2% by 2025. France will be the biggest negative factor, with demand also weak in the Benelux countries and the Nordic region. The recent collapse of the Dutch government could further worsen this outlook. On the positive side, the Southern European market remains strong overall and is still on a growth trajectory.

North American tariff uncertainty impacts the construction industry.

North American construction machinery sales declined by 5% last year, a smaller drop than expected. Despite high interest rates, residential construction remained strong, even showing slight growth, which significantly supported the stability of sales of small construction machinery. Meanwhile, the infrastructure sector remained active, and the non-residential building sector benefited from the progress of several large chip factory and data center projects.

The cyclical downturn in the North American market is expected to continue this year, and the inflationary and anti-trade tariff policies introduced by the Trump administration may significantly exacerbate this downward trend.

Construction machinery has a high steel content, which means that the price of imported models (which account for about 20% of the market share) will increase by nearly 50%. At the same time, the cost of models manufactured in the United States, although most of the parts are sourced from the United States, may still increase by about 20% because some parts need to be imported from abroad and some of the parts purchased domestically also contain foreign components.

Uncertainty surrounding tariff policies and their ongoing changes have created market uncertainty and eroded market confidence. This will lead to investment delays, and Off-Highway Research predicts that, as a result, North American construction machinery sales will decline by 11% this year, which would be the largest drop among all major markets in 2025.

The situation may improve next year – core drivers such as housing demand and the data center boom (which brings huge electricity demand) should be beneficial to the industry. However, continued inflation caused by tariffs (which could force interest rates to rise further), a large number of newer models left over from the market boom of the early 2020s, continued uncertainty, and chaotic policymaking could all disrupt this positive trend.

India becomes a growth construction market.

Sales of construction machinery in India grew by 10% last year, reaching a record high. Less disruption to the industry from the general election and the upcoming new emissions standards for road mobile construction machinery, set to take effect in early 2025, contributed to the significant sales surge in the last few months of the year. This "early purchase" phenomenon is common when regulatory changes lead to increased equipment costs.

This situation has effectively brought forward some of the sales expected for 2025 to 2024, thus anticipating a 9% decline in Indian construction machinery sales this year. Furthermore, the reduced number of tenders issued by the Indian government may slow road construction progress, raising market concerns.

However, from the perspective of the overall Indian construction machinery market, these are merely minor disruptions. The Indian market has maintained strong long-term growth momentum and is currently the world's third-largest construction machinery market (by sales volume), after the United States and China.

The Japanese market is volatile.

The Japanese construction machinery market saw an unusually strong 7% growth in 2023 (for Japan), but experienced a similar sharp decline in 2024, with sales falling by 9%. Last year, sales in the Japanese market were slightly below 63,000 units, slightly below its "natural level" of about 65,000 units per year.

Despite sluggish sales in 2024, the market is expected to remain at a relatively low level for the next 1-3 years. This is partly due to the large number of newer models currently available in the Japanese market resulting from high sales during the pandemic; on the other hand, President Trump's unpredictable policy decisions and their potential impact on the global economy have also created market uncertainty.

South American inflation drags down equipment sales.

After reaching an unprecedented peak in 2022, the South American construction machinery market experienced a significant downturn in 2023 due to inflationary conditions. Last year, driven by the mining, oil, and gas sectors, sales in South America saw a slight recovery of 1%. The market is expected to enter a mild cyclical downturn for most of the remainder of the decade – as the surge in sales in the early 2020s has completed the replacement of the equipment fleet. However, mining-related construction machinery is expected to perform well thanks to a relatively optimistic outlook for various commodities. The mining industry is characterized by a preference for "low-volume, high-value" equipment; therefore, despite the anticipated decline in sales, the overall value and health of the South American construction machinery market will remain at a reasonable level.

What is the current market situation in other regions?

Similar to South America, the global construction machinery market in other regions is primarily comprised of emerging economies whose wealth creation is largely tied to some form of mining. High commodity prices enabled this diverse group of countries to achieve 5% sales growth last year—a stark contrast to the stagnant market growth they experienced in 2023 due to high interest rates and inflation.

Global commodity prices are expected to remain high in the coming years, and Off-Highway Research believes this price level is sufficient to drive moderate growth in construction machinery sales in these regions.

Looking ahead to future sales of construction machinery.

Off-Highway Research predicts that global and regional sales of construction machinery will see steady growth starting in 2026. This growth will drive the market to a cyclical peak in the early 2030s, exceeding the 2021 high driven by economic stimulus policies in terms of sales volume.

In these times, one point is worth remembering: in the long run, construction machinery sales have consistently shown an upward trend. The global population continues to grow, increasing the demand for infrastructure and housing; and the construction industry, which undertakes these tasks, is becoming increasingly mechanized. Excluding cyclical fluctuations, the compound annual growth rate (CAGR) of construction machinery sales is approximately 2%.

Source: Machinery Intelligence Network

Please read on, stay posted, subscribe, and we welcome you to tell us what you think.

Add: Pudang Village, Xiamei Town, Nan'An City, Quanzhou, Fujian, China

Quanzhou Huamao Machinery Equipment Co.,Ltd All Rights Reserved.  Network SupportedSitemap | blog | Xml | Privacy Policy

Network SupportedSitemap | blog | Xml | Privacy Policy